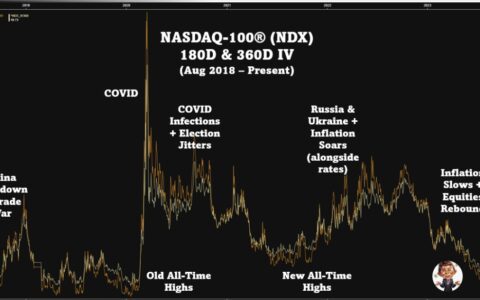

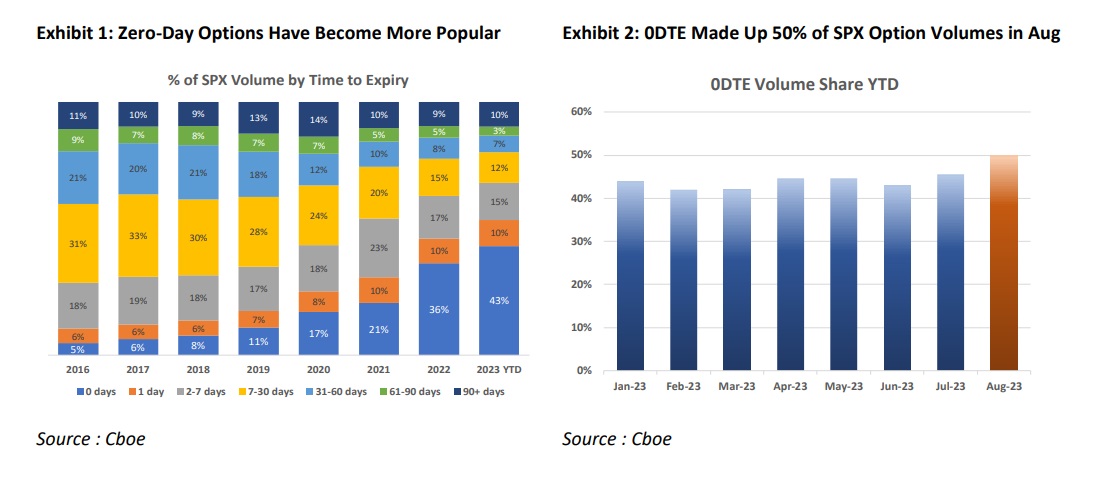

In the kaleidoscopic world of stock and options trading, there are few phenomena that have garnered as much attention as the Zero Days to Expiry options, or 0DTEs. With their explosive growth in popularity – rocketing from 5% of SPX® options volume in 2016 to a staggering 50% this August, they’ve ignited imaginations and sparked widespread debate. The question on everyone’s lips: Is the dramatic surge in 0DTEs warping the very fabric of the markets? Let’s delve deep and separate the chaff from the grain.

Understanding Gamma Hedging:

Before we address the lion in the room, it’s crucial to grasp the concept of gamma hedging. Gamma mirrors the shift in the option delta with every flicker in the underlying asset price. It’s the yardstick that shows how much market makers will need to rejig their delta hedge. Essentially, it reveals how much they’d have to shuffle in S&P futures for a 1% jig in the SPX index.

Two core facets stand out:

- Magnitude: A towering number hints at the potential gargantuan impact of option hedging.

- Sign: Being long gamma is akin to dancing against the wind. If the SPX index sways up, market makers have to sell futures; if it tumbles down, they’re buying. This could potentially cushion market oscillations. However, being short gamma is like flowing with the tide – and this could amplify market swings.

High Volume ≠ High Risk:

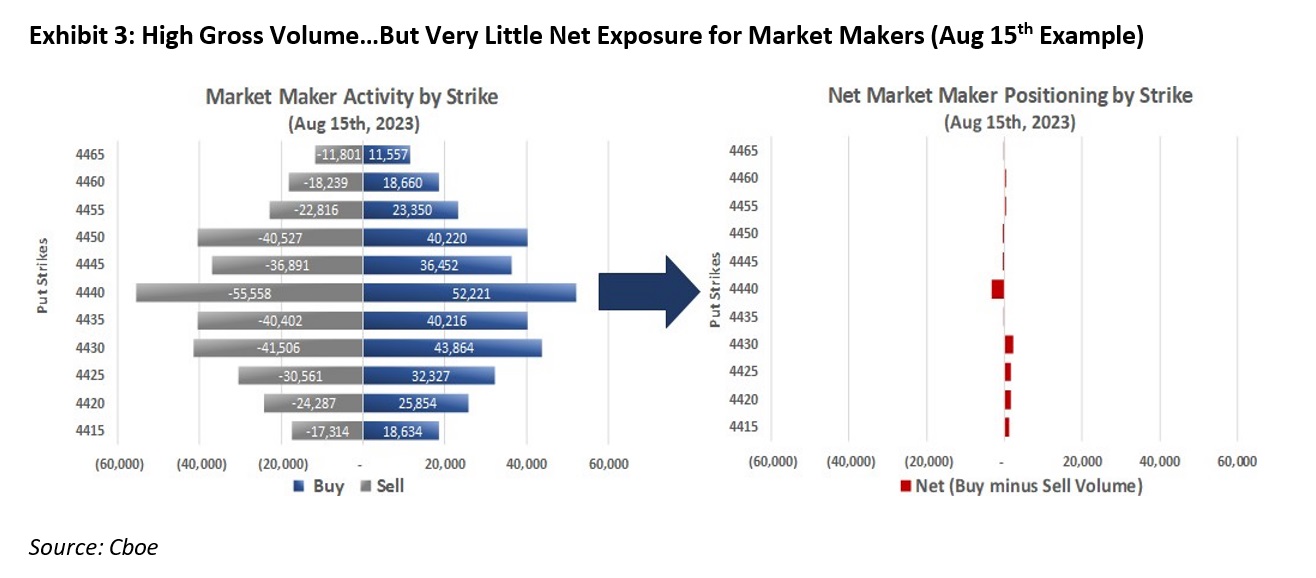

When you see numbers like 1.23m contracts, equivalent to a whopping $500bn notional, traded daily in 2023, it’s easy to assume that risk is directly proportional to volume. But this notion is a mirage. The crux isn’t the total volume but the equilibrium between buys and sells. And, as the enigmatic data from Cboe® demonstrates, the flow is astoundingly balanced. For instance, on Aug 15th, a buzzing 100k contracts on the 4440-strike put changed hands, but market makers were only left marginally short by the day’s end.

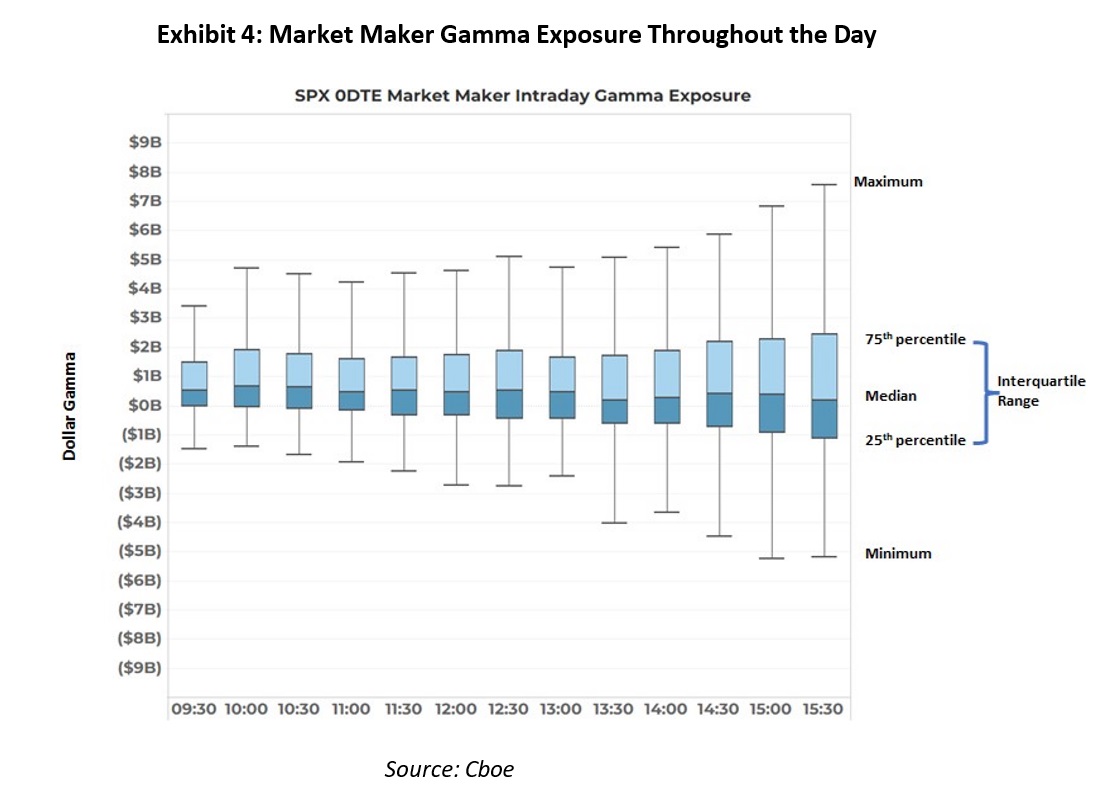

Diving Deep into Market Maker Gamma Analysis:

On probing market maker’s net positioning, a startling picture emerges. The median net gamma at the cusp of the market close (3:30 pm) is a mere +$173mm. Even at its wildest, it only oscillates between -$5bn to +$7.7bn, which, when juxtaposed with the daily S&P futures volume, seems almost insignificant. It’s pivotal to realize that these figures are only a snapshot of SPX 0DTE options. Market makers could have other aces up their sleeves, with offsetting positions in myriad other products or expiries.

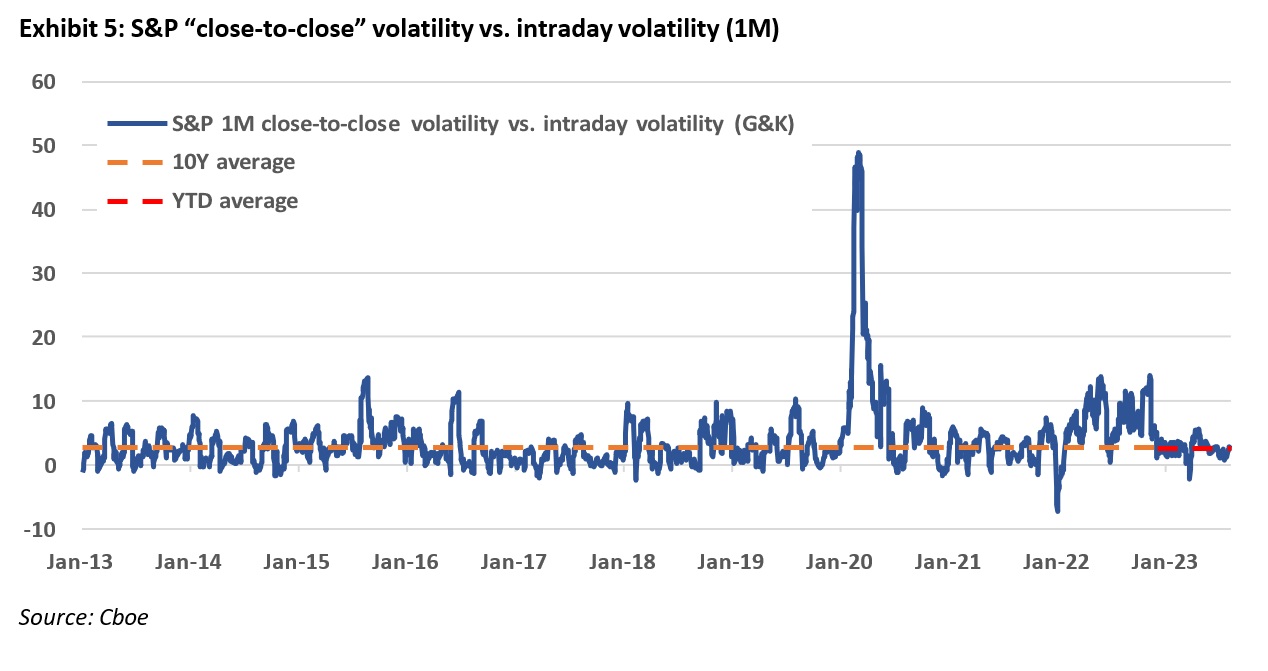

Does 0DTEs Rock the S&P Intraday Volatility Boat?

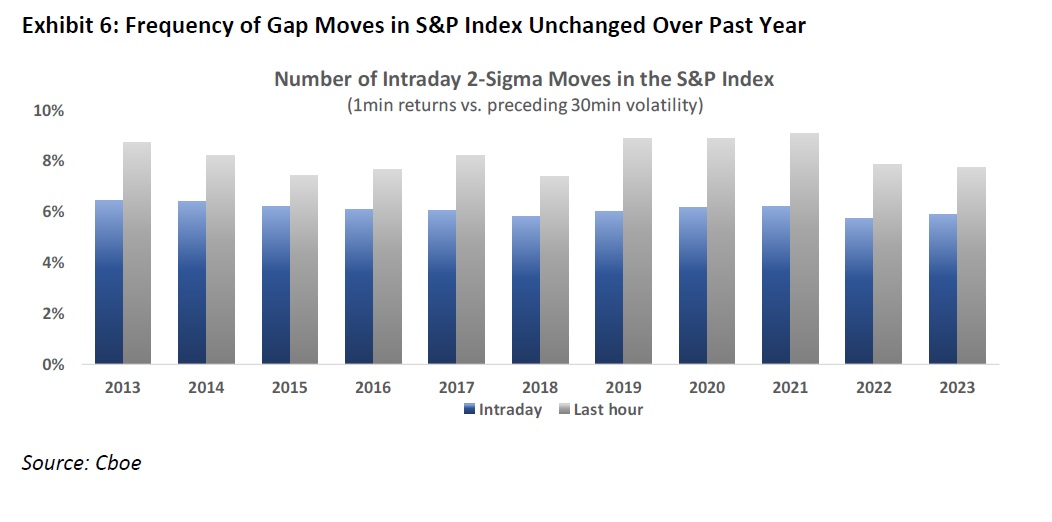

An intriguing lens to examine the ripple effects of 0DTE options is the SPX index’s intraday conduct. And, as the charts reveal, it’s as calm as a serene pond. The fluctuation between S&P close-to-close and intraday realized volatility dovetails perfectly with historical precedents. Moreover, there’s no surge in abrupt gap moves, suggesting that 0DTEs haven’t unleashed chaos on the market.

Conclusion:

Piercing through the haze, it becomes evident that the hullabaloo around SPX 0DTEs is largely unfounded. Despite the impressive notional volume coursing through daily, the net exposure remains minuscule, fluttering between 0.04% to 0.17% of the daily S&P futures liquidity. The SPX index remains unflappable, with its intraday rhythms pulsing in harmony with historical norms. At its heart, the balanced trading nature of 0DTEs, with a rich tapestry of both institutional and retail investors, ensures the market remains robust, resilient, and resistant to undue influences.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/unraveling-the-spx-0dte-enigma-beyond-volume-to-true-market-impact.html