Introduction

Value investing is a time-tested investment strategy that has been employed by some of the world’s most successful investors, such as Warren Buffet. It involves seeking out stocks that are undervalued by the market – in other words, stocks that are trading for less than their intrinsic or fundamental value. This blog post will introduce the concept of value investing, explore its key principles, and discuss some strategies that value investors use to identify promising investment opportunities.

Value Investing

The Core Philosophy

Value investing is based on the belief that the market often overreacts to good and bad news, resulting in stock price movements that do not correspond with a company’s long-term fundamentals. This overreaction offers the value investor an opportunity to profit when the price is less than its intrinsic value. The aim is to buy these stocks at a ‘discount’ and hold them until the market corrects, and the stock price reflects its true value.

Understanding Intrinsic Value

The intrinsic value of a company is its true, inherent worth, considering all aspects – tangible and intangible. Calculating intrinsic value is not an exact science and often involves a degree of educated estimation. Key factors often include a company’s earnings, future profitability, cash flow, and the net value of its assets.

Just as important as finding undervalued stocks is ensuring the companies themselves are high quality. Look for companies with strong management, a competitive advantage, or ‘moat,’ and a track record of profitability. These features often suggest that a company can withstand economic downturns and potentially offer consistent long-term growth.

Margin of Safety

One of the key principles in value investing is the concept of the ‘margin of safety.’ It involves purchasing stocks at a price significantly below their calculated intrinsic value to allow room for error in the valuation. This safety net helps protect investors from substantial losses in case of unexpected adverse events or miscalculations in the company’s intrinsic value.

Financial Statement Analysis

Value investing requires a deep dive into a company’s financials. Investors need to become comfortable reading income statements, balance sheets, and cash flow statements to understand a company’s financial health. Key aspects to consider are consistent earnings growth, strong cash flow, and low debt-to-equity ratio, among others.

The Importance of Patience

Value investing is not a get-rich-quick scheme. It requires patience and a long-term perspective. Once an undervalued stock is bought, it could take several years for its price to reflect its intrinsic value. It’s important to remain patient and resist the temptation to sell off if the stock doesn’t perform in the short term.

The Dangers of Falling into ‘Value Traps’

A ‘value trap’ is a stock that appears to be undervalued but is actually priced low due to underlying problems within the company. To avoid value traps, it’s crucial to conduct thorough research to ensure that the company’s fundamentals are strong and it has potential for future growth.

As with any investment strategy, value investing is not without risk. The market might take longer than expected to recognize a stock’s true value, or it might never do so. Or, you might have overestimated the stock’s intrinsic value in your analysis. It’s crucial to consider these risks, diversify your investments, and never invest money you can’t afford to lose.

Value Investing Strategies

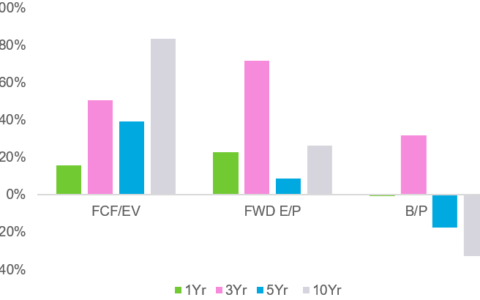

Relative Valuation

Relative valuation involves comparing the valuation multiples of the company you’re evaluating with other similar companies in the market. Common valuation multiples include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and price-to-sales (P/S) ratio. Companies that have lower valuation multiples compared to their peers could potentially be undervalued.

Absolute Valuation

Absolute valuation models aim to find a company’s intrinsic value independent of the market. The most popular absolute valuation model is the Discounted Cash Flow (DCF) model, which calculates the present value of a company’s expected future cash flows.

Contrarian Approach

Value investing often involves a contrarian mindset. It’s about buying stocks when pessimism pushes their prices below their intrinsic value and holding them despite potential short-term popularity losses. This approach requires confidence in one’s analysis and the conviction to stick with your investment decisions even when they’re not in line with current market trends.

Conclusion

In essence, value investing is about finding diamonds in the rough – stocks with strong fundamentals that, for one reason or another, the market has overlooked. It’s about thorough research, patience, and a commitment to sound fundamental analysis. While it requires effort and a long-term perspective, for those who practice it diligently, the rewards can be significant. After all, in the words of Warren Buffet, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/unlocking-wealth-a-comprehensive-guide-to-value-investing-and-its-strategic-approach.html