Introduction

Exchange-traded funds (ETFs) have become a popular investment choice due to their unique features and benefits. Unlike traditional mutual funds, ETFs trade on stock exchanges throughout the day and offer a diversified basket of assets, such as stocks or bonds. In this comprehensive blog post, we’ll address five critical questions to help you gain a deeper understanding of ETFs, enabling you to make more informed investment decisions.

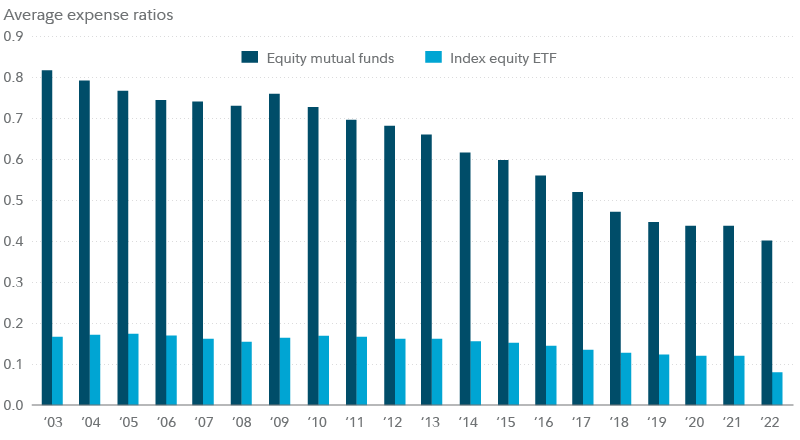

Are all ETFs relatively cheap?

One of the significant attractions of ETFs is their cost-effectiveness. However, it’s essential to remember that not all ETFs are created equal in terms of expenses. While many ETFs maintain lower expense ratios compared to mutual funds, there is still a range of costs associated with ETF investing.

When evaluating ETF costs, consider not only the expense ratio but also factors such as tracking error and bid-ask spreads. Some ETFs may be more cost-effective due to low tracking error and narrow bid-ask spreads. In contrast, others may come with additional expenses related to trading. It’s important to thoroughly research and choose ETFs that align with your investment goals and risk tolerance.

Do ETFs pay dividends?

ETFs often hold dividend-paying stocks within their portfolios, which means they can generate dividends for investors. However, the timing and distribution of these dividends can vary. While some ETFs pay out dividends as soon as they are received from the underlying holdings, most distribute dividends on a quarterly basis.

Investors have the flexibility to opt for receiving dividends in cash or reinvesting them to purchase additional shares. It’s advisable to consult the ETF’s prospectus to understand its dividend distribution process fully. Some brokerage platforms, like Fidelity, may offer commission-free dividend reinvestment.

Are all ETFs passive?

The majority of ETFs are passively managed, meaning they aim to replicate the performance of a specific index, such as the S&P 500. However, there is a category of ETFs known as “smart beta” ETFs, which are also passively managed but aim to enhance their return profile or modify their risk profile relative to a market benchmark.

Additionally, some ETFs are actively managed, and their objective is to outperform a particular benchmark. Active management allows fund managers to make decisions that may lead to different securities or weightings compared to the underlying index. Understanding whether an ETF is passively or actively managed is crucial for making informed investment decisions.

Are all ETFs tax-efficient?

Tax efficiency is a significant consideration for investments held in taxable accounts. ETFs, in general, are considered tax-efficient because of their unique structure and lower portfolio turnover. Unlike mutual funds, ETFs can minimize capital gains distributions due to their creation/redemption structure, which avoids triggering taxable events.

However, not all ETFs are equally tax-efficient. Consider factors such as the type of dividends an ETF distributes, whether they are qualified or nonqualified. Qualified dividends are typically taxed at lower rates. ETF investors may be subject to the relevant tax rates on distributions based on their individual circumstances.

To maximize tax efficiency with ETFs, consider holding tax-inefficient ETFs in tax-deferred or tax-exempt accounts. It’s also advisable to consult with a qualified tax advisor if you have specific concerns regarding taxes.

Are all ETFs relatively liquid?

One of the key advantages of ETFs is their trading flexibility, allowing investors to buy and sell shares throughout the trading day. However, the liquidity of ETFs can vary, depending on factors such as the bid-ask spread and average daily trading volume.

A narrow bid-ask spread and high average daily trading volume are indicators of a highly liquid ETF. On the other hand, some narrowly focused or niche ETFs may have wider spreads, potentially making trading in them more expensive.

To identify highly liquid ETFs, you can use tools like ETF screeners to filter options based on attributes like bid-ask spreads and trading volumes. Additionally, consider using limit orders when trading ETFs to ensure you execute trades at the desired price point.

Conclusion

Understanding the intricacies of ETFs is vital for making informed investment decisions. ETFs offer a range of benefits, including cost-effectiveness, liquidity, and tax efficiency, but not all ETFs are the same. By addressing these five essential questions and conducting thorough research, you can harness the power of ETFs to build a well-rounded and efficient investment portfolio that aligns with your financial goals and risk tolerance. Remember to evaluate any investment option with your specific circumstances, time horizon, and risk tolerance in mind.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/unlocking-the-world-of-etfs-5-must-know-facts-for-investors.html