Retiring is a big step for many Americans. It’s a time of reflection and celebration, as well as planning for the future. While each individual will have their own goals and plans, there are some that are more common among elderly Americans than others. In this blog post, we will be exploring the top 8 retirement goals of elderly Americans. We’ll talk about why these goals are important and how they can be achieved. Whether you’re already retired or working towards it, this article will provide valuable insight into the dreams and aspirations of today’s seniors.

Health and Wellness

As we age, our health and wellness becomes increasingly important. According to a recent survey, the top retirement goal of elderly Americans is to stay healthy and active. This includes maintaining a healthy weight, getting regular exercise, and having regular checkups with their doctor.

staying active is very important as you get older. Regular physical activity can help you maintain your independence, improve your balance and coordination, and reduce your risk of falls. It can also help you manage chronic conditions such as arthritis, diabetes, and heart disease.

If you’re not already active, start slowly and build up gradually. Try to do at least 30 minutes of moderate-intensity aerobic activity on most days of the week. This could include walking, swimming, or biking. If you can’t do 30 minutes all at once, break it up into smaller segments throughout the day.

In addition to being physically active, eating a healthy diet is also important for maintaining your health as you age. Make sure to eat plenty of fruits, vegetables, whole grains, and low-fat dairy products.Limit saturated fat and cholesterol, which can lead to heart disease. And choose foods that are low in salt and added sugars.

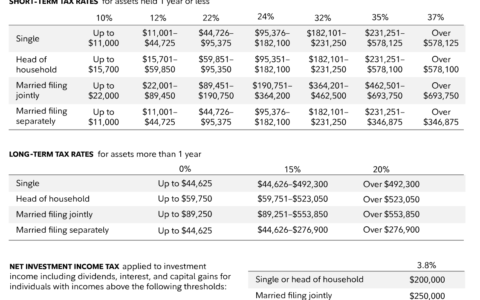

Financial Stability

One of the top retirement goals of elderly Americans is financial stability. This can be achieved by having a comfortable nest egg to live on, as well as having enough money to cover unexpected expenses.

To have a comfortable nest egg, it is recommended that you have at least 10 times your final salary saved up. For example, if you want to retire with an annual income of $50,000, you would need to have at least $500,000 saved. This may seem like a daunting task, but it can be achievable if you start saving early and make wise investments.

Another way to achieve financial stability in retirement is to have a plan for covering unexpected expenses. This could include having an emergency fund that covers at least 3-6 months of living expenses, as well as long-term care insurance to cover the costs of any future medical needs. By planning ahead and being prepared for the unexpected, you can help ensure that your golden years are truly happy and stress-free.

Maintaining Social Connections

As people age, it’s important to maintain social connections. Whether it’s staying in touch with friends and family or getting involved in the community, social interaction can help stave off loneliness and improve mental and physical health.

One way to stay connected is to use technology, like social media or video chat. If you’re not comfortable using a computer or smartphone, there are still plenty of ways to stay in touch. You can write letters, make phone calls, or even get together in person (if you’re able).

It’s also important to get out and about, whether that means going for walks around the neighborhood or taking part in activities at a senior center. Getting some fresh air and being around other people can do wonders for your mood and overall well-being.

Whatever you do, don’t isolate yourself. Making an effort to stay connected will pay off in the long run by keeping you happy, healthy, and engaged in life.

Having a Sense of Purpose

A recent study found that the top retirement goal of elderly Americans is having a sense of purpose. In fact, nearly 60% of respondents said that having a sense of purpose is what they are most looking forward to in retirement.

For many, the retirement years are a time to finally focus on personal interests and pursuits that may have been put on the back burner during their working years. Whether it’s travel, volunteering, taking up a new hobby, or spending more time with family and friends, having a sense of purpose can give retirees a renewed sense of satisfaction and enjoyment in life.

Of course, not everyone knows exactly what their purpose will be in retirement. That’s okay! The important thing is to stay open-minded and actively pursue activities that bring you joy. With a little exploration, you’re sure to find an activity (or several!) that brings meaning to your retirement years.

Finding Housing that Meets Their Needs

As people age, their housing needs change. Some may downsize to a smaller home or apartment that is easier to care for. Others may need to move into a facility that can provide more support, such as an assisted living community or a nursing home.

There are many factors to consider when choosing housing in retirement. Cost is often a major concern, as fixed incomes can make it difficult to afford rent or mortgage payments. Location is also important, as retirees may want to be close to family or friends, or near amenities like shopping and medical facilities.

retirees should take the time to research their options and find housing that meets their needs and budget. There are many resources available to help, including government programs and private organizations. With careful planning, retirees can find the perfect place to call home in their golden years.

Continuing to Learn and Grow

As we get older, it becomes more and more important to keep our minds active and engaged. Learning new things and keeping our brains challenged can help stave off cognitive decline and keep us sharp well into our golden years.

There are plenty of ways to stay mentally active as we age. One is to simply make a point of learning something new every day. This could be anything from learning a new recipe or the history behind a favourite song, to picking up a new hobby or taking an online course on a topic that interests you. Staying curious and keeping your mind open to new experiences will help keep you mentally young.

Another great way to keep your mind sharp is by staying socially engaged. Connecting with others, whether in person or through social media, can help stimulate your brain and keep you feeling connected and involved in the world around you. Joining a book club, going for coffee with friends, or attending community events are all great ways to stay social in retirement.

Finally, exercise is also important for maintaining cognitive function as we age. Exercise not only benefits our physical health, but can also improve brain health by increasing blood flow and neuroplasticity. So get out there and take a walk, go for a swim, or join a fitness class – your mind will thank you!

Managing Medications and Health Conditions

As we age, it becomes more important to take control of our health and manage medications and health conditions effectively. This can be a challenge, as many older adults have multiple chronic conditions and take several different medications.

However, there are steps we can take to make sure we’re managing our medications and health conditions effectively. First, it’s important to keep track of all the medications we’re taking and why we’re taking them. This includes over-the-counter medications, supplements, and herbal remedies.

It’s also important to keep track of our health conditions and any changes or new symptoms we experience. This can help us identify problems early on and get the treatment we need. Finally, it’s crucial to communicate with our healthcare team about our medications and health conditions. We should let them know about any changes or new symptoms so they can provide the best care possible.

Planning for the End of Life

“It’s never too early to start planning for the end of life. Even if you’re in good health, it’s important to think about your wishes for medical care and your final arrangements.

One of the most important things you can do is to designate a healthcare proxy. This is someone who will make decisions about your medical care if you are unable to do so yourself. You should also have a living will that outlines your wishes for end-of-life care.

You should also start thinking about your final arrangements, such as whether you want to be cremated or buried. If you want to be buried, you’ll need to purchase a cemetery plot and make arrangements with a funeral home. If you’re opting for cremation, you’ll need to decide what to do with your ashes.

It’s also important to update your estate planning documents, such as your will and power of attorney. And don’t forget to name a beneficiary for your retirement accounts.

Thinking about the end of life can be daunting, but it’s important to plan ahead. By taking these steps now, you can ensure that your wishes are carried out and that your loved ones are taken care of.”

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/top-8-retirement-goals-of-elderly-americans.html