The recent downgrade of the United States’ credit rating by Fitch Ratings from AAA to AA+ has stirred the financial world, raising concerns and sparking debates. This action represents only the second time in U.S. history that such a decision has been taken, the first being by Standard & Poor’s in 2011. In this blog post, we will explore the rationale behind Fitch’s decision, the immediate consequences, and the potential long-term implications for the U.S. economy and global financial markets.

Rationale Behind the Downgrade

The factors cited by Fitch for the downgrade mirror those that led to the 2011 action by S&P. The issues include the U.S. government’s repeated debt limit standoffs and last-minute resolutions, coupled with growing debt fueled by tax cuts, new spending, and the escalating cost of entitlement programs such as Social Security and Medicare. In fact, these two programs alone accounted for more than $2.3 trillion in June, or about 9% of U.S. GDP.

While the U.S. maintains strength with its large and diversified economy, challenges are visible on the horizon, including predictions of a mild recession toward the end of 2023 and early 2024.

Immediate Repercussions

1. Impact on Treasuries and Stocks

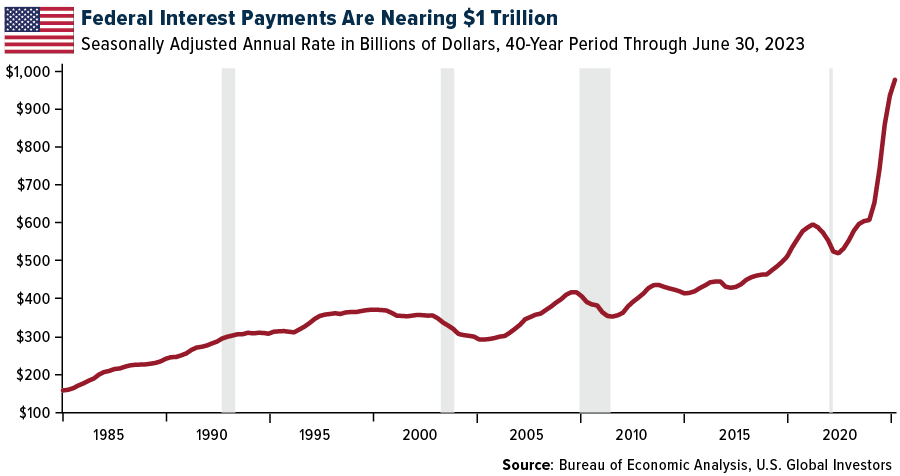

The credit downgrade already influenced Treasury yields, which pushed higher post-decision, with the 30-year yield exceeding 4.3% for the first time since November. This can increase the country’s borrowing costs, possibly deepening its debt burden.

2. Currency Devaluation

There’s a risk of currency devaluation if foreign investors decide to sell off their holdings, increasing the supply of the currency in foreign exchange markets.

3. Stock Market Volatility

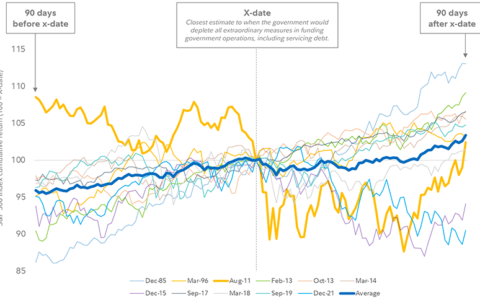

We have witnessed short-term volatility in the stock markets reminiscent of August 2011 when the VIX jumped significantly.

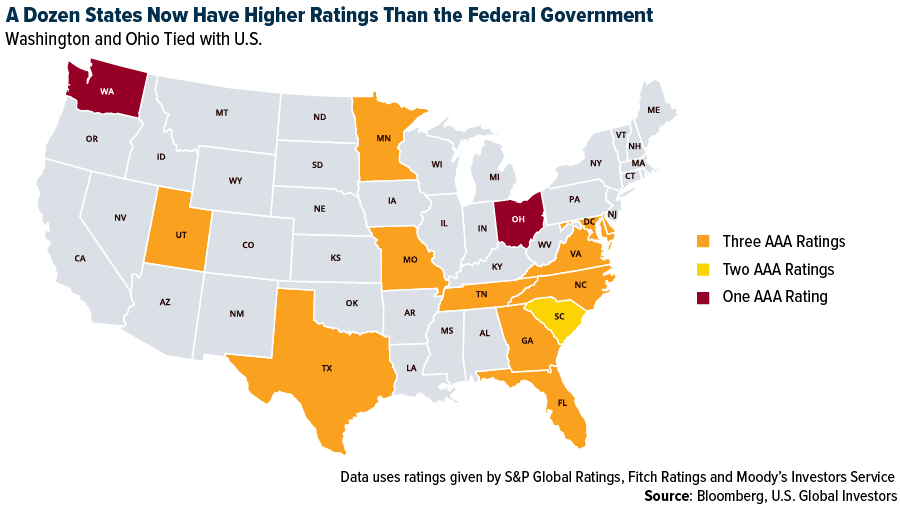

4. State Credit Ratings

Interestingly, with the federal government downgraded, 12 U.S. states, including Texas and Florida, now boast higher credit ratings, indicating robust local economies.

Changing Correlations and Investment Strategies

1. Treasuries and Stocks Correlation

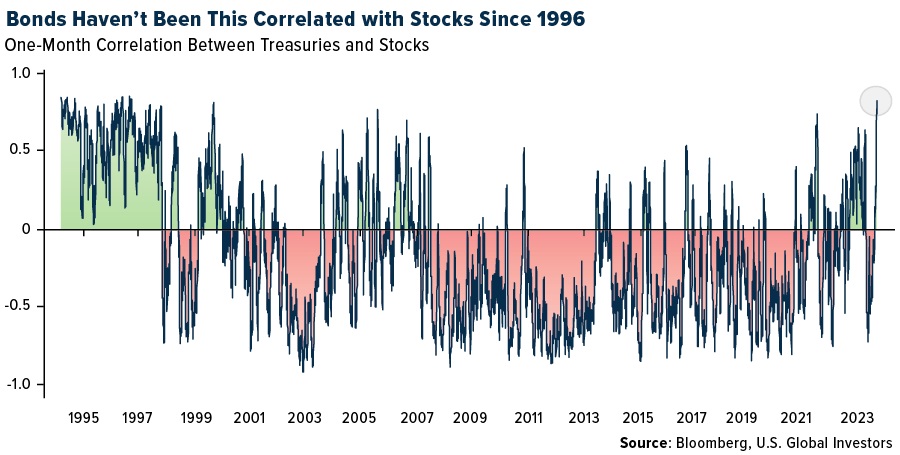

The traditional low to negative correlation between Treasuries and stocks has been shifting. The correlation has strengthened to 0.82, the highest since 1996, indicating a weaker bond hedge against equity risks.

2. Equity-Risk Premium Shrinks

With yields heading higher, the equity-risk premium has dropped to its lowest in two decades. This may not directly signal a market downturn, but Wall Street consensus suggests that this cannot persist indefinitely.

3. Gold and Silver as Diversifiers

Gold and silver continue to look attractive as portfolio diversifiers due to their respective negative and negligible correlations with the S&P 500.

Looking Ahead: Opportunities and Challenges

The ripple effects of America’s new credit rating have begun to surface, and they will likely continue to unfold in the coming months. Investors should remain vigilant and responsive to these changes, keeping an eye on developing trends and adjusting their strategies accordingly.

The present situation illustrates the fluid and dynamic nature of financial markets. Changes in credit ratings, correlations, and market indicators are challenges that require agile investment strategies. But they also present opportunities for those willing to adapt and innovate.

In conclusion, Fitch’s downgrade of the U.S. credit rating is a significant event with multifaceted implications. While the immediate consequences are tangible, the long-term impact on the global economy remains to be seen. These are intriguing times in the world of finance, and the key to navigating them successfully is to stay informed, stay adaptive, and most importantly, stay invested.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/the-credit-downgrade-wake-up-call-analyzing-the-ripple-effects-of-americas-shift-from-aaa-to-aa.html