The investment landscape is evolving, with bonds now nearing a point where they might just outshine stocks. As we step into this new era, many investors are understandably looking for ways to boost their yield without substantially increasing their risk. If you are among this group, there’s an innovative strategy you might want to consider.

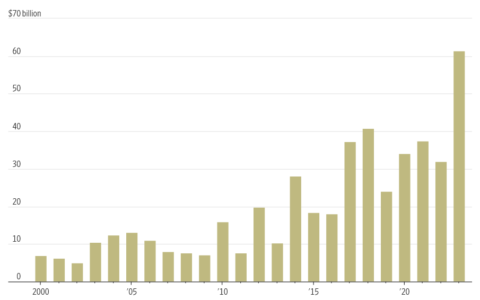

Bonds: The New Attraction

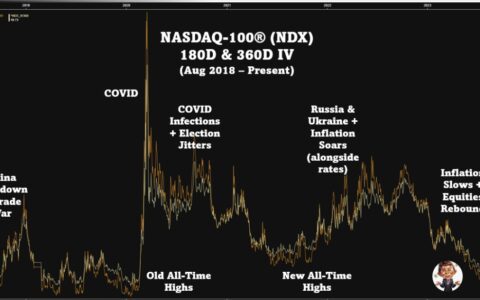

Many investors today are reveling in returns of 5% or even higher from their money-market funds or short-term government bonds. This is a pleasant shift, especially when you consider the 10-year Treasury bond yielding around 4.3%. Such a risk-free return is certainly attractive, especially after enduring various historical market shocks like the Asian contagion of 1998, the bursting of the internet bubble in 2000, the 2008-09 global financial crisis, the 2020 Covid meltdown, and the present situation with central banks hiking interest rates to combat inflation.

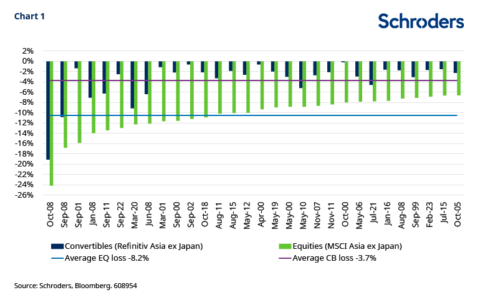

While the cash return might be below the stock market’s long-term annual average of about 9%, there is a way for investors to enhance yields without incurring high risks.

A Blend of Bonds and Equity Options

Here’s a strategy for those keen on optimizing yields:

- Diversify: Allocate 80% or 90% of your cash into bonds. Put the remainder into an interest-bearing account with your broker that allows financing for options strategies.

- Sell Puts: Opt for blue-chip stocks that have long-term value. Sell puts on them. Currently, these puts carry attractive premiums as buyers are eager to secure themselves from market downside.

- Puts Specifications: Aim for selling puts that are roughly 10% out-of-the-money and have an expiration window of four to six weeks. This could yield about a 1% monthly return on the cash you’ve secured for the put.

The Key Benefit: This approach offers investors an enticing fixed-income yield while also tapping into the rising fear-premiums in put options. The majority of an investor’s assets are in bonds, and the funds required to finance cash-secured put sales also earn attractive interest. Any put premium is just a bonus.

What Are The Risks?

The risks tied to selling cash-secured puts mirror those of buying stocks: potential monetary loss. Factors like unexpected rate hikes by the Federal Reserve, a significant downturn in China’s economy, or declining corporate earnings can swing market sentiments, causing short-term reactions to dominate long-term goals.

Therefore, always proceed with caution, keeping your personal risk tolerance in mind. It’s essential to monitor the 10-Year Treasury bond yield, a metric that profoundly influences stock market dynamics.

Historically, stock markets have been uneasy with 10-year yields surpassing 4%. Such high yields can distort popular valuation models that estimate multiyear earnings. Especially vulnerable are market-leading tech stocks whose prices represent anticipated multiyear revenue flows. If yields persist in their upward trajectory, it could induce a fall in stock prices.

Embracing Time Arbitrage

This combined approach of bonds and options prepares investors for what we often term as “time arbitrage”. In the midst of an unpredictable stock market, it’s vital to be discerning with your choice of strike prices and expirations. An essential rule of thumb: never sell puts on a stock you wouldn’t be comfortable owning.

In conclusion, the changing landscape demands adaptability and strategic thinking. By integrating bonds with a carefully managed options strategy, investors can harness the benefits of both worlds, securing attractive yields while keeping risks at bay. As always, staying informed and vigilant is the best way to navigate these financial waters.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/optimizing-yields-in-a-shifting-landscape-a-bond-and-options-blueprint.html