Introduction

Building a solid credit history in the United States is essential for various aspects of life, from getting a mortgage to leasing a car. One way to accumulate a good credit score is by using credit cards responsibly. American Express is a reputable provider of credit cards, and this article will provide a zero-based application tutorial for its credit cards, helping you build your American credit history.

- Understand American Express credit card options:

Before you apply for an American Express credit card, familiarize yourself with the different options available. American Express offers a variety of credit cards, including those that cater to cashback rewards, travel, and small businesses. Research the card that best suits your financial needs and spending habits.

- Assess your eligibility:

Before applying for a credit card, ensure that you meet the eligibility requirements. Most American Express credit cards require applicants to have a good credit score (usually 670 or above). Additionally, you must be at least 18 years old and have a valid Social Security number.

- Gather required documents:

To apply for an American Express credit card, you’ll need your Social Security number, date of birth, contact information, total annual income, and other relevant financial information. Keep these documents handy to streamline the application process.

- Apply online:

Visit the American Express website and navigate to the specific credit card you’re interested in. Click on the “Apply Now” button and fill out the online application form with the necessary information. It’s essential to be accurate and honest when providing your details.

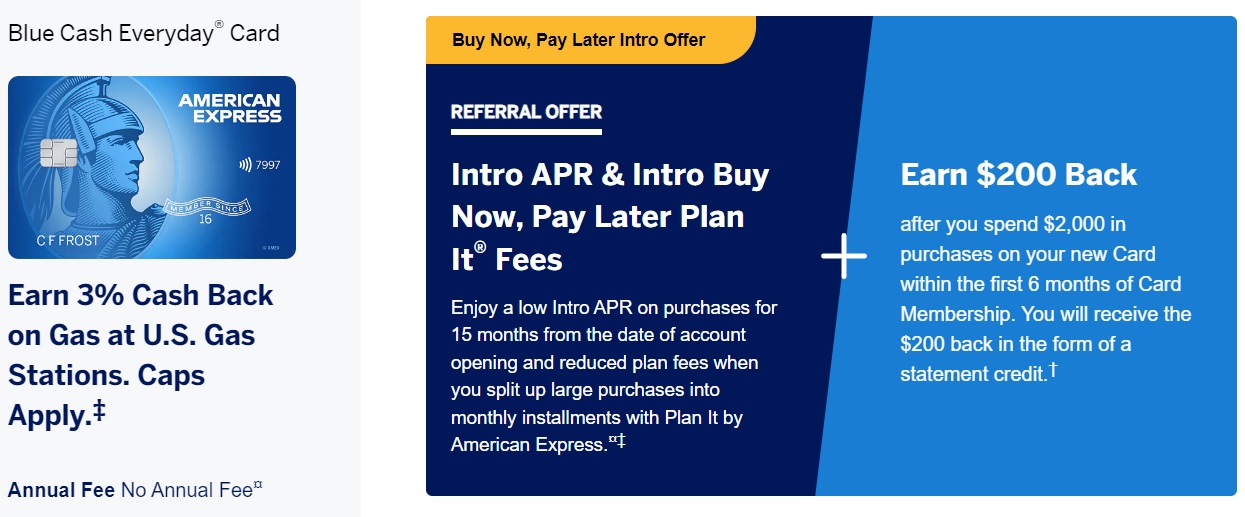

The American Express Blue Cash Everyday Credit Card is a popular choice among consumers seeking a rewarding credit card option for everyday spending. With no annual fee and a generous cashback rewards program, this card is designed for those who want to make the most of their daily purchases while building a solid credit history in the process.

One of the standout features of the Blue Cash Everyday Credit Card is its cashback rewards program. Cardholders can earn 3% cash back on purchases at U.S. supermarkets (up to $6,000 per year, then 1%), 2% cash back at U.S. gas stations and select U.S. department stores, and 1% cash back on all other purchases. These rewards are automatically credited as statement credits, making it easy to redeem your earnings and save on future purchases.

In addition to its cashback rewards, the Blue Cash Everyday Credit Card offers an attractive welcome bonus for new cardholders. Typically, this bonus consists of a cashback amount awarded after spending a certain amount within the first few months of opening the account. This bonus can help jumpstart your earnings and maximize the value of the card from the beginning.

The American Express Blue Cash Everyday Credit Card also provides essential benefits that add value to your overall experience. These benefits include car rental loss and damage insurance, global assistance hotline, and purchase protection, which covers eligible purchases against accidental damage or theft for a specific period after purchase.

While the Blue Cash Everyday Credit Card is designed for those with good to excellent credit scores, American Express is known for its strong customer service and willingness to work with customers to improve their credit standing. By using this card responsibly, you can establish a positive credit history and enjoy the rewards and benefits that come with being a Blue Cash Everyday cardholder.

- Wait for the decision:

After submitting your application, American Express will review your information and make a decision. Approval times can vary, but you should typically receive a response within a few minutes to a few days. In some cases, American Express may require additional information or documentation, which can delay the decision.

- Activate your card:

Once your application is approved and you receive your American Express credit card, you’ll need to activate it. You can do this by calling the number provided with your card or activating it online through your American Express account.

- Use your card responsibly:

To build a solid credit history, use your new American Express credit card responsibly. This means paying your balance in full each month, keeping your credit utilization rate low (below 30% of your credit limit), and avoiding late payments.

- Monitor your credit score:

Regularly check your credit score to track your progress in building your credit history. You can use free services like Credit Karma or Experian to monitor your credit score and view your credit report. Additionally, American Express offers free access to your FICO score for most cardholders.

- Leverage credit card benefits:

Maximize the benefits of your American Express credit card by utilizing the rewards, discounts, and other perks offered. This can include travel insurance, purchase protection, or exclusive access to events. Remember that these benefits are only worthwhile if you’re using your card responsibly and not overspending to earn rewards.

- Consider adding additional cards:

As you build your credit history and improve your credit score, you may become eligible for other American Express credit cards that offer even better rewards and benefits. Consider adding additional cards to your wallet to take advantage of these offers and continue building your credit history.

Conclusion

Building a solid credit history in the United States is crucial for achieving financial success. By following this zero-based application tutorial for American Express credit cards, you can start accumulating your American credit history and enjoy the benefits that come with responsible credit card use.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/mastering-american-express-a-comprehensive-guide-to-building-your-credit-history.html