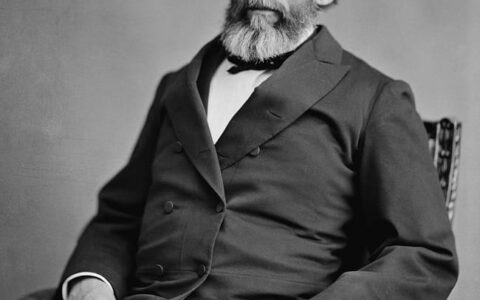

“Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett The World’s Most Famous Investor” (Buy from Amazon) by Mary Buffett and David Clark is a comprehensive guide to the investment philosophy and strategies of Warren Buffett, one of the world’s most successful investors. The book provides an in-depth look at the principles and techniques used by Buffett to select stocks and achieve long-term investment success.

The authors begin by introducing the reader to Warren Buffett’s investment philosophy and explaining his focus on value investing. They then provide a step-by-step guide to the financial analysis techniques used by Buffett, including a detailed explanation of the three key financial statements (balance sheet, income statement, and cash flow statement) and how they can be used to evaluate a company’s financial health.

One of the strengths of “Buffettology” is the authors’ clear and concise writing style. They do an excellent job of breaking down complex financial concepts into simple terms, making the book accessible to readers of all levels of investment knowledge. The book also includes numerous examples and case studies that help to illustrate key concepts and strategies.

The authors also discuss the importance of patience and discipline in investing, emphasizing the need to stick to a well-defined investment strategy and avoid making impulsive or emotional decisions. They explain how Buffett avoids market speculation and instead focuses on finding undervalued companies with strong financials and a competitive advantage.

Another highlight of “Buffettology” is the discussion of Warren Buffett’s famous “circle of competence” concept. The authors explain how this concept can be used to identify the industries and companies that an investor is most knowledgeable about and can therefore make the best investment decisions.

While the book provides a wealth of information about Warren Buffett’s investment philosophy and strategies, it is important to note that it does not provide a one-size-fits-all solution for investment success. The authors emphasize that every investor must find the investment approach that works best for them, based on their individual circumstances, risk tolerance, and financial goals.

In conclusion, “Buffettology” by Mary Buffett and David Clark is a comprehensive and accessible guide to the investment philosophy and strategies of Warren Buffett. Whether you are a seasoned investor or just starting out, this book is a valuable resource for anyone looking to improve their investment skills and achieve long-term financial success.

About the Author:

Mary Buffett is an author, investor, and philanthropist. She is best known for her books about the investment philosophy and strategies of Warren Buffett, her former father-in-law. Mary has written several books on the subject, including “The New Buffettology,” “The Tao of Warren Buffett,” and “Warren Buffett and the Interpretation of Financial Statements.”

Throughout her career, Mary has shared her insights into Warren Buffett’s investment approach and provided practical advice for individual investors looking to apply his principles to their own portfolios. She is a sought-after speaker and has made numerous appearances on financial news programs and at investment conferences.

In addition to her writing and speaking career, Mary is also actively involved in philanthropic efforts. She supports a number of charitable organizations, including those focused on education, health, and environmental conservation.

Overall, Mary Buffett is known for her expertise on the investment philosophy and strategies of Warren Buffett, and her practical and accessible approach to financial analysis and investment.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/mary-buffett-buffettology-book-review.html