As parents, we all want the best for our children. Part of setting them up for success involves teaching them about money, savings, and investing at an early age. The sooner you start guiding your teens and adult kids on the path to financial security, the better positioned they’ll be for their future. Helping them save and invest wisely now can give them a tremendous advantage down the road.

In this blog post, we’ll explore six tips and tools that can help your kids build a solid financial foundation. Whether it’s saving for healthcare, retirement, education, or just teaching them good money habits, these strategies can set them on the path to financial independence and success.

1. Health Savings Accounts (HSAs) – A Triple Tax Advantage

One of the lesser-known ways to supercharge savings for your children is through a Health Savings Account (HSA). While HSAs are typically associated with healthcare, they offer unique benefits for young people, especially if they’re enrolled in an HSA-eligible health plan. Here’s how it works:

An HSA provides a triple tax advantage:

- Tax-deductible contributions

- Tax-free growth

- Tax-free withdrawals for qualified medical expenses

Your teen or young adult child can benefit from this account even before they enter the workforce. If your child is under 26, they can still be on your health insurance plan, meaning they can take advantage of this powerful savings tool. And if they’re paying for their own insurance, they can open their own HSA.

While contributions to the HSA are limited by the IRS, they can add up over time, and the account can be used for more than just immediate medical expenses. Once they start contributing, your child will enjoy tax-free growth and have funds available for future healthcare costs—without worrying about taxes eating away at their earnings.

Parents can also contribute to their child’s HSA, and while they won’t receive a tax deduction for these contributions, their child can claim it.

2. Open a Roth IRA for Retirement Savings

It’s never too early to start saving for retirement, and a Roth IRA is a great tool for getting your children started. This account offers tax-free growth and tax-free withdrawals in retirement, making it a powerful way for your child to build wealth for the future.

If your child earns any income, whether it’s from a part-time job, side hustle, or freelance work, they can contribute to a Roth IRA. Even young children, as long as they have earned income, can open what is called a custodial Roth IRA. The beauty of this account is that it grows tax-free, and the contributions can be withdrawn at any time without penalty—though there are penalties for early withdrawals of earnings.

A custodial Roth IRA can be opened by a parent or guardian. Once the child reaches adulthood (the age varies by state), the account transitions into their name. What’s even better is that, if your child qualifies, they can also withdraw up to $10,000 tax-free for a first-time home purchase—an added bonus for when they’re ready to make the leap into homeownership.

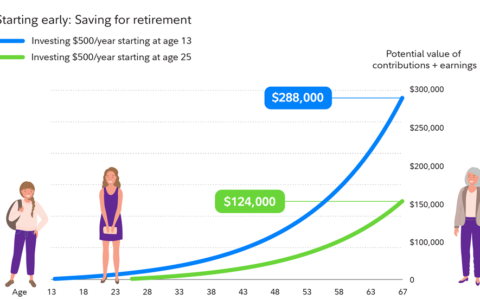

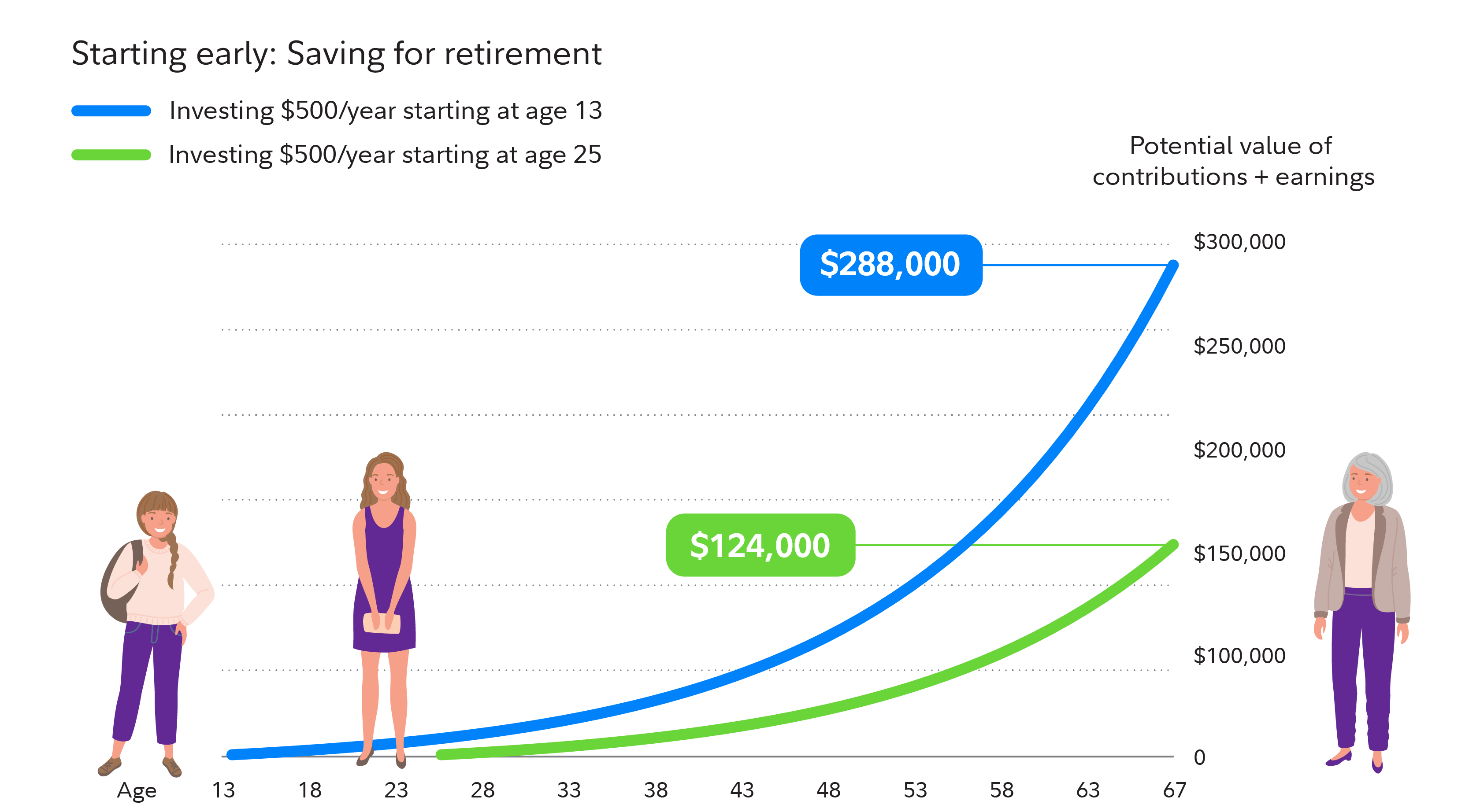

Starting a Roth IRA early can pay huge dividends in the future, thanks to the compounding nature of long-term investing.

Although investing and compounding may help you grow your money, please remember that investing involves risk. You could lose money, investment returns are likely to fluctuate, and investing on a regular basis does not ensure you’ll make more money. These examples are hypothetical and don’t reflect the performance of any specific investment. Illustrations assume no withdrawals and continuous saving over the entire period shown.

This hypothetical example of an early saver assumes the following: (1) A $500 contribution is made on January 1 every year from age 13 to 67. It does not take into account SECURE Act 2.0 indexing of catch-up contributions, which will be implemented on January 1, 2025. (2) An annual rate of return of 7%, and (3) the ending values do not reflect taxes, fees, or inflation. If they did, amounts would be lower. Illustrations with a 7% rate of return also come with risk of loss.

This hypothetical example of a later saver assumes the following: (1) A $500 contribution is made on January 1 and every year from age 25 to age 67, (2) an annual rate of return of 7%, and (3) the ending values do not reflect taxes, fees, or inflation. If they did, amounts would be lower. For hypothetical illustration only. Investing involves risk, including risk of loss. Source: Fidelity Investments.

3. 529 College Savings Plans & Rollovers to Roth IRAs

Saving for college expenses can feel daunting, but 529 college savings plans are a great way to ease that burden. These tax-advantaged accounts can be used for a variety of educational expenses, from tuition and textbooks to K-12 schooling and vocational training. The earlier you start, the more your savings will grow.

For example, if you start saving $3,000 annually in a 529 plan when your child is born, the compound growth could be significant by the time they head to college. But if you wait until your child is 10 years old to start saving, you’d need to contribute almost $6,700 annually to reach the same goal.

The great thing about 529s is that they offer flexibility. Not only can the beneficiary of the plan be changed to another family member, but, under new laws, you can now roll over up to $35,000 from a 529 plan to a Roth IRA for the beneficiary, subject to the annual Roth IRA contribution limits. This gives you even more options for ensuring the money is used for the long-term benefit of your child’s financial future.

While withdrawals from a 529 plan that are not used for qualified educational expenses are subject to penalties, the ability to transfer funds into a Roth IRA adds another layer of flexibility to the 529 savings strategy.

4. Building Credit Early

A strong credit score is one of the most important factors in financial success. It affects everything from the interest rates on loans to eligibility for renting an apartment. But how do you help your child start building credit? One way is by adding them as an authorized user on your credit card.

By adding your teen or young adult child to your credit card account, they’ll start to build credit without having to take on debt themselves. Keep in mind, though, that you, as the primary account holder, will still be responsible for the payments. And if you use a rewards card, like the Fidelity® Rewards Visa Signature® card, you’ll benefit from any spending your child does with the card.

The best part? The available credit and payment history will be reported to all major credit bureaus, which can help your child establish a solid credit history by the time they start managing their own financial responsibilities.

5. Fidelity Youth® Account: A Teen-Friendly Investment Account

In today’s world, investing is no longer just for adults. Teens can begin learning about and participating in the world of investing with tools like the Fidelity Youth® Account. This is a teen-owned brokerage account that allows kids as young as 13 to start investing—under the supervision of a parent or guardian.

The Fidelity Youth Account gives teens the opportunity to learn about investing, develop money management skills, and start building wealth for their future. By giving your child control of their investments, with your guidance, you can teach them the importance of long-term planning, risk management, and building wealth over time.

This is an excellent way to foster financial literacy and help your children develop good habits when it comes to saving and investing.

6. Custodial Accounts: Teach Kids About Investing

Finally, consider setting up a custodial account (UGMA/UTMA) for your child. These accounts are brokerage accounts that allow adults (usually parents) to invest money on behalf of a minor. The money in the account can be used for the child’s benefit, whether for education, a first car, or other needs.

One of the best parts of custodial accounts is that they have no contribution limits, and the money can be invested in stocks, bonds, or mutual funds. Additionally, custodial accounts offer tax advantages: some of the earnings are tax-free or taxed at the child’s lower tax rate.

These accounts are an excellent way to help your child get involved in investing and building their own wealth while learning valuable lessons about money management.

Set Your Kids Up for Financial Success

Teaching your children about saving and investing is one of the most valuable things you can do for their future. By utilizing these tools and strategies, you’ll be helping them build a solid financial foundation that will benefit them for years to come. Encourage them to get involved early, make informed decisions, and always remember that small steps today can lead to big results tomorrow.

Involve your children in the process, and make it a family effort. Help them set goals, review their progress, and celebrate their successes. The earlier you start, the better prepared they will be to navigate the financial challenges and opportunities that lie ahead.

By taking action now, you’ll give your kids a significant head start in achieving financial security and independence.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/give-your-kids-a-money-head-start-6-tips-and-tools-to-help-them-save-and-invest-for-the-future.html