Introduction:

In the ever-evolving landscape of financial markets, the resurgence of FOMO (Fear of Missing Out) is undeniable. Traders are making bold moves, shifting away from the perceived safety of cash and diving headfirst into a realm of risk assets, chasing quick profits and riding the wave of a renewed appetite for speculation. This blog post delves into the dynamics of FOMO, dissecting the balance between fear and greed that underpins market movements.

The Psychology of FOMO:

At its core, FOMO is a manifestation of greed, despite the “F” standing for fear. The dichotomy between the fear of losing money and the greed for greater profits creates a delicate equilibrium that drives market sentiments. This phenomenon is not exclusive to individual investors; professionals, including portfolio managers in both equity and fixed income, are feeling the pressure to keep up with performance benchmarks and peers, leading to a cascade effect of momentum in the market.

The Everything Rally and the Role of Rate Expectations:

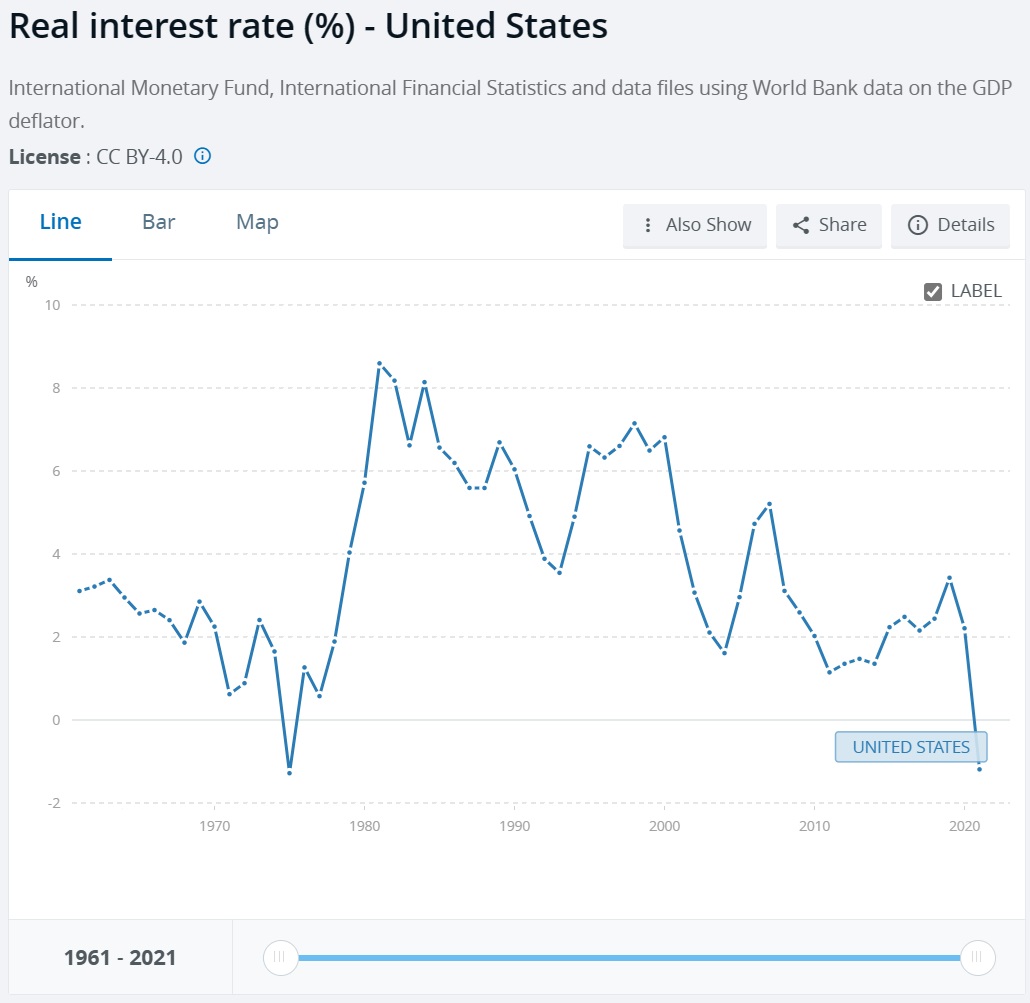

The root cause of the current “everything rally” lies in the expectation of declining interest rates. Positive interpretations of recent Fed statements and influential figures like Bill Ackman have led to Fed Funds futures pricing in a potential rate cut in May, rather than June. The impact extends across various asset classes – from stocks to bonds, gold, and even Bitcoin – as investors anticipate a favorable environment for risk assets.

Understanding the Link Between Rates and Asset Valuations:

From a theoretical standpoint, falling interest rates have widespread implications for asset valuations. Bonds reflect rate movements directly, while for stocks, lower rates increase the present value of future cash flows, positively influencing stock prices. Gold, often seen as an “anti-dollar,” benefits from a weakening dollar prompted by lower interest rates. The allure of liquidity has even fueled excitement in the cryptocurrency market, particularly Bitcoin, with anticipation of ETF listings.

Cautionary Notes on Rate Cut Anticipation:

Amidst the excitement, a note of caution arises. There is a need to scrutinize the rationale behind the market’s enthusiasm for rate cuts. Questions arise about the timing and necessity of a rate cut in May. If a soft landing is expected, what prompts the Fed to act so early? The historical context, the absence of sustained 2% inflation, and the potential influence of the upcoming election year add layers of complexity to the situation.

Election Year Dynamics and Future Market Expectations:

Looking ahead to the next year, which is an election year, considerations about the Fed’s historical reluctance to alter rates before elections come into play. While the Fed may act if economic circumstances dictate, the market’s current pricing may not align with the actual conditions that would warrant such actions.

Conclusion:

In the midst of the FOMO-driven rush for profits, investors and traders alike must approach the market with a discerning eye. The allure of liquidity and the anticipation of rate cuts carry both opportunities and risks. As market dynamics continue to unfold, staying informed, considering historical precedents, and understanding the underlying motivations will be crucial for navigating this exciting yet unpredictable landscape. Be cautious what you wish for, and always be prepared for the unexpected in the ever-shifting world of finance.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/fomo-is-back-navigating-the-greed-driven-surge-in-risk-assets.html