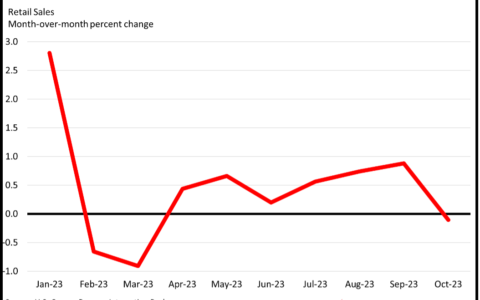

While recent economic data may paint an optimistic picture of the economy, a deeper analysis reveals a more precarious situation. The University of Michigan’s consumer survey indicates consumer sentiment, current conditions and future expectations are all on the rise, albeit with 1-year inflation expectations also increasing. This paints a paradoxical picture of a booming economy in contrast to rising inflationary pressures and higher than expected core inflation. Amidst this background, investors and economists are cautiously observing a brewing ‘Minsky Moment’ – a term that resonates with unsettling echoes from the past.

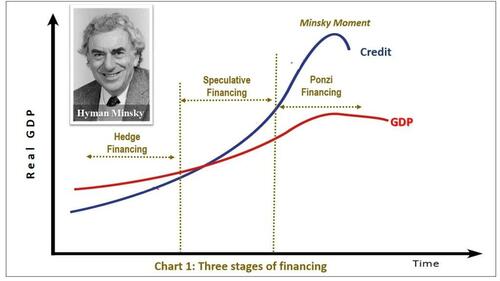

Hyman Minsky, an American economist, was best known for his theories on the financial instability of economies, where periods of economic prosperity can lead to speculative bubbles and eventually a financial crisis. The phrase “Minsky Moment” refers to the tipping point when the economy transitions from stability to instability, from a prolonged period of growth to a sudden economic downturn, usually as a result of speculation and unsustainable financial practices.

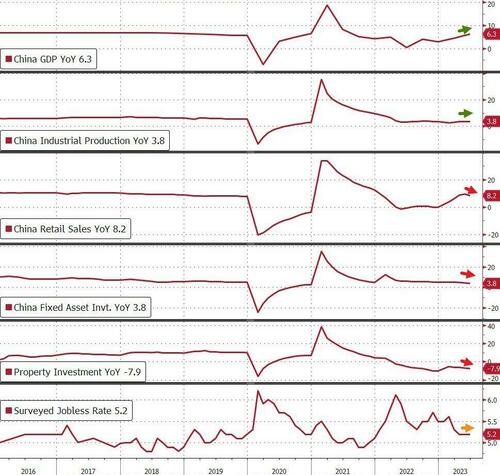

The recent events in the U.S., China, and the U.K. seem to indicate that we are nearing such a moment. While we rejoice at the seemingly positive core inflation of 4.8%, China’s starkly contrasting consumer price growth of zero and escalating producer price deflation send shockwaves throughout trade-exposed economies. Adding to this are the slower than expected expansion of China’s GDP and weakening manufacturing and trade figures. These signs of a struggling economy, coupled with high debt loads and a simmering real estate crisis, spark growing concern.

Globally, the commercial real estate markets are also facing a “Waterloo” moment. Rising worker bargaining power, quiet-quitting, and higher discount rates due to extensive monetary tightening, have significantly diminished demand for office spaces. This shift has affected commercial real estate valuations and moved them towards what Minsky defined as Ponzi-financing, where cash flows from the assets are insufficient to meet financing liabilities and principal repayments.

The housing markets, often the epicenter of financial crises, are showing worrying signs of instability, especially in the U.K. Here, homeowners are grappling with mounting requests for mortgage relief, as the Bank of England faces the daunting task of maintaining a delicate balance between tightening monetary policy and controlling runaway inflation. Long-term implications are even more concerning. The practice of extending mortgage terms, and the increased likelihood of negative equity, point towards a drift into Ponzi-financing territory, thereby increasing financial fragility.

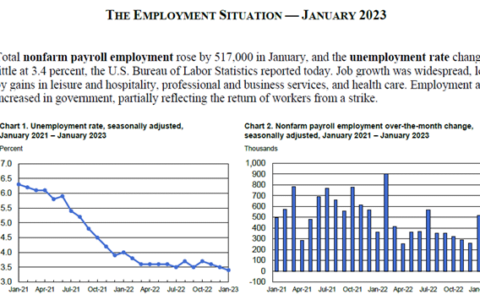

A consistent rise in unemployment, as forecasted by many central banks, will further strain homeowners and increase the risk of a broad-based default. The culmination of these factors could lead to a housing market collapse, igniting a ‘Minsky Moment’ and destabilizing the broader economy.

In this light, the role of central banks is increasingly challenging. They are tasked with balancing their inflation targets with financial stability, a tricky task when the two objectives appear to be at odds. How they navigate these choppy waters will significantly influence the potential for a ‘Minsky Moment’. In Australia, for example, financial stability is the purview of the banking regulator, while the Reserve Bank focuses on the financial well-being of Australians. The U.S. Federal Reserve and the European Central Bank, on the other hand, are considering financial stability as a significant factor in their decision-making.

The question, therefore, is whether we are taking one step forward, only to take two steps back. Have years of government assistance for first home buyers, in conjunction with unprecedentedly low-interest rates, set the stage for a ‘Minsky Moment’ by creating instability in the real estate markets? If so, a momentary pause in monetary tightening on the back of temporarily encouraging inflation readings could be a dangerous mistake. It’s essential to consider the broader implications of these decisions and the potential for a sudden, destabilizing economic downturn.

As we observe these unfolding events, it’s important to remember that the best defence against a ‘Minsky Moment’ is a sound financial structure and policy framework that prevents excessive speculation and unsustainable financial practices. Central banks, governments, and financial institutions must work together to ensure that we maintain this balance and prevent our economies from stepping back into a financial crisis.

In conclusion, the global economy stands on a precarious edge, with the threat of a ‘Minsky Moment’ looming large. While many economic indicators may suggest progress, the underlying challenges in the housing market, the uncertainties surrounding inflation, and the delicate state of China’s economy provide a cause for concern.

Financial stability requires maintaining a keen eye on potential warning signs and adopting preventative measures to keep economies from tipping into crisis. Central banks, governments, and financial institutions must remain vigilant, focusing on maintaining the right balance between stimulating economic growth and preventing the build-up of speculative bubbles.

Ignoring these warning signs or underestimating their potential impact could result in an economic backslide. Yet, acknowledging them and proactively addressing them offers us an opportunity to step forward without taking two steps back, thereby preventing a potential ‘Minsky Moment’.

As we stand at this economic crossroads, the path forward is still ours to chart. It’s essential that we learn from our past, make prudent decisions, and strive to foster financial resilience in an ever-evolving economic landscape. After all, only by recognizing and mitigating the risks we face can we hope to avert the impending ‘Minsky Moment’ and ensure our economies’ sustained stability and prosperity.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/dancing-on-the-edge-the-threat-of-a-minsky-moment-in-the-global-economy.html