Introduction

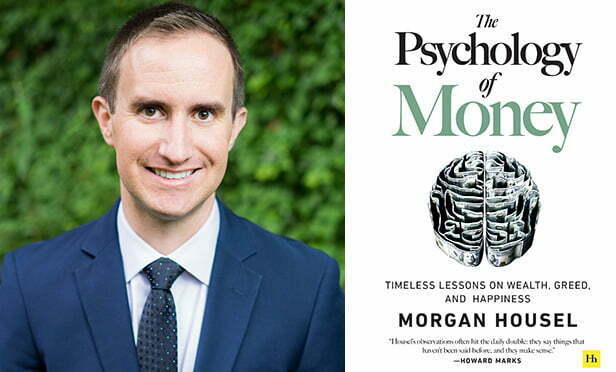

For anyone looking to get ahead financially, understanding the psychology of money is essential. In his book, The Psychology of Money (buy from Amazon), Morgan Housel reveals the secrets to financial success and provides readers with the tools to unlock their own financial potential. In this review, we’ll explore the key takeaways from Housel’s book and how it can help readers become more financially literate and make better financial decisions.

Understanding the Psychology of Money

Housel begins by examining the psychological factors that drive people’s decisions when it comes to money. He argues that our emotions and biases often prevent us from making wise choices, which can lead to financial ruin. He explains that it’s essential to understand our own thought processes when it comes to money in order to make sound decisions that will lead to long term success.

Unlocking the Secrets of Financial Success

Housel walks readers through the steps to becoming financially successful. He outlines the basics of budgeting and investing, as well as the importance of setting financial goals. He also provides helpful advice on how to save money and avoid common pitfalls.

How Morgan Housel’s “The Psychology of Money” Can Help

Housel’s book is an invaluable resource for anyone looking to gain a better understanding of money and finance. He explains the psychological components of financial decisions, and provides practical advice on how to become financially successful.

Generating Wealth with Financial Literacy

Housel emphasizes the importance of financial literacy, and explains how it can be used to generate wealth. He outlines strategies to increase financial literacy, such as reading books, taking courses, and talking to experts. He also provides tips on how to use financial literacy to make smarter investment decisions.

Financial Decisions & Their Emotional Impact

Housel also examines how our emotions can influence our financial decisions. He explains how emotions such as fear, anxiety, and greed can lead to poor decisions and ultimately, financial ruin. He provides readers with strategies to identify and manage their emotions so that they can make better financial choices.

How to Make Smart Financial Choices

Housel explains that making smart financial decisions involves looking beyond the short term and focusing on the long term. He outlines the importance of setting financial goals and investing for the future. He also provides advice on how to avoid common mistakes and pitfalls, such as investing in risky assets or spending more than you earn.

Harnessing Your Emotions for Financial Gain

Housel argues that our emotions can also be used to our advantage when it comes to money. He explains how we can use our emotions to make better decisions and take advantage of opportunities. He encourages readers to use their emotions to make informed decisions that will lead to long term financial success.

The Benefits of Financial Planning

Housel also outlines the benefits of financial planning. He explains how financial planning can help readers achieve their financial goals and make better decisions. He provides tips on how to get started with a financial plan, as well as how to manage and update it.

Overcoming Fear and Anxiety of Money

Housel also addresses the fear and anxiety that often surrounds money. He explains that it’s important to confront our fears and understand our own thoughts and feelings when it comes to money. He provides strategies to help readers overcome their fear and anxiety and take control of their financial future.

Unlocking Your Financial Potential with Morgan Housel

Housel’s book is an invaluable resource for anyone looking to gain a better understanding of money and finance. He provides practical advice on how to become financially successful, as well as how to make smarter decisions and take advantage of opportunities.

Conclusion

Housel’s book, The Psychology of Money, is an invaluable resource for anyone looking to gain a better understanding of money and finance. He provides practical advice on how to become financially successful, as well as how to make smarter decisions and take advantage of opportunities. By understanding the psychological factors that drive our financial decisions, readers can learn to make better choices and unlock their financial potential.

Top Ten Key Takeaways

1. Understanding the psychology of money is essential for financial success.

2. Setting financial goals and investing for the future are key to achieving long term success.

3. Financial literacy is key to generating wealth.

4. Our emotions can influence our financial decisions and should be managed accordingly.

5. Making smart financial decisions involves looking beyond the short term.

6. Harnessing our emotions can be used to our advantage when it comes to money.

7. Financial planning can help readers achieve their financial goals.

8. It’s important to confront our fears and understand our own thoughts and feelings when it comes to money.

9. Morgan Housel’s book provides practical advice on how to become financially successful.

10. Understanding the psychology of money can help readers make better decisions and unlock their financial potential.

With the help of Morgan Housel’s book, The Psychology of Money, readers can gain a better understanding of money and finance and unlock their own financial potential. By understanding the psychological factors that drive our financial decisions, readers can learn to make better choices and take control of their financial future. With the right knowledge, readers can achieve financial success and reach their goals.

So what are you waiting for? Start unlocking your financial potential today by picking up a copy of Morgan Housel’s The Psychology of Money.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/a-review-of-the-psychology-of-money-by-morgan-housel-unlocking-the-secrets-of-financial-success.html