Economic downturns are inevitable. While no one can predict exactly when a recession will strike, preparing ahead of time can dramatically reduce the emotional and financial stress when one hits. During tough times, the strength of your financial plan is truly tested—often in ways you may not have imagined. The good news? A well-structured, proactive approach can help you weather economic uncertainty with resilience and confidence.

Despite ongoing concerns, the U.S. economy continued to grow through the first quarter of 2025. Still, uncertainty can drive anxiety, especially when it comes to money. The key to thriving in a downturn is to build a strong financial foundation and maintain the discipline to stick with it. As a financial advisor, I’ve seen how emotional decisions during volatile periods can do more harm than good. Let’s explore six effective, research-backed strategies to recession-proof your life.

1. Practice Mindfulness to Make Better Money Moves

When the economy becomes unstable, your emotions can cloud your financial judgment. Fear and anxiety often trigger two opposing but equally risky behaviors: total disengagement or over-engagement with your finances.

Some people avoid checking their accounts, fearing the worst. Others panic and start selling investments impulsively. Both reactions can derail a sound financial plan.

Practicing mindfulness helps you stay aware of your emotions and make more rational choices. Instead of reacting instinctively, you pause, reflect, and assess whether your actions align with your long-term goals. Before making major money moves, ask yourself:

- Am I acting out of fear or strategy?

- Is this decision consistent with my financial goals?

- What will I think of this decision a year from now?

Just a few minutes of mindful reflection can help you make better, calmer financial decisions—even during turbulent times.

2. Build—or Stress-Test—Your Financial Plan

If you don’t have a financial plan, now is the time to build one. A comprehensive plan helps you understand where you are financially, where you want to go, and how to get there. But even if you already have a plan, it’s essential to stress-test it.

Stress-testing involves modeling “what-if” scenarios—what if you get laid off and can’t find work for six months? What if the market drops 25%? How will these changes impact your ability to meet your goals?

David Peterson, head of wealth planning at Fidelity, points out that these “big shocks” are the ones to worry about. By modeling worst-case scenarios, you’ll gain clarity on:

- How much emergency liquidity you need

- What expenses you can reduce or defer

- How your retirement or college savings plans might be affected

Having answers to these questions—before disaster strikes—can help you sleep better at night and act more decisively if things take a turn.

3. Look for Ways to Spend Less or Earn More

This is a time-tested principle: when you can’t increase income quickly, the next best step is to manage spending. Cutting costs isn’t glamorous, but it can create the breathing room you need to build savings or manage through income disruptions.

Start by getting a rough overview of your current budget. You don’t need to log every coffee purchase—but it’s important to know your fixed expenses (rent, utilities, insurance) and your flexible ones (dining out, entertainment, subscriptions). Even small changes, like canceling unused services or cooking more at home, can free up cash.

At the same time, explore side gigs or freelance opportunities. Can you tutor, write, consult, or offer services online? The gig economy offers more flexibility than ever, and even a modest bump in income can help stabilize your finances.

4. Bolster Your Emergency Savings

Emergency savings are your financial life jacket. They provide a cushion when income stops or unexpected expenses pop up.

The typical recommendation is to save three to six months’ worth of essential expenses. This can seem daunting, especially if you’re starting from scratch. The good news is that you don’t need to do it all at once.

Start with a small, achievable goal—say, $1,000. Then work steadily toward the larger goal by automating monthly transfers to a high-yield savings account. If your job or industry is particularly volatile, consider saving even more than six months’ worth.

Keep this money relatively liquid. It doesn’t all need to sit in cash, but you should be able to access it quickly in a pinch. Consider low-risk vehicles like money market funds or short-term CDs that offer a balance between yield and accessibility.

5. Stay the Course with Your Investments

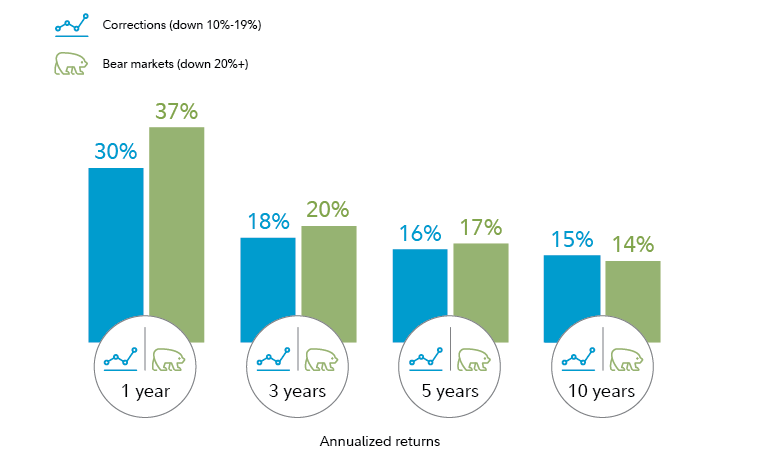

Market volatility is a feature, not a bug, of investing. It’s uncomfortable—but not unusual—for the market to experience corrections (declines of 10-20%) or even bear markets (declines of 20% or more). But here’s what history teaches us: markets do recover.

Stock market trade-offs

| Historically, on average, investors | |

| have received: | have tolerated: |

|---|---|

| ~8% annual return | 3 downturns of 5% per year |

| Positive calendar returns ~75% of the time | 1 correction of 10% per year |

| 1 correction of ~15% every 3 years | |

| 1 bear market greater than 20% every 6 years | |

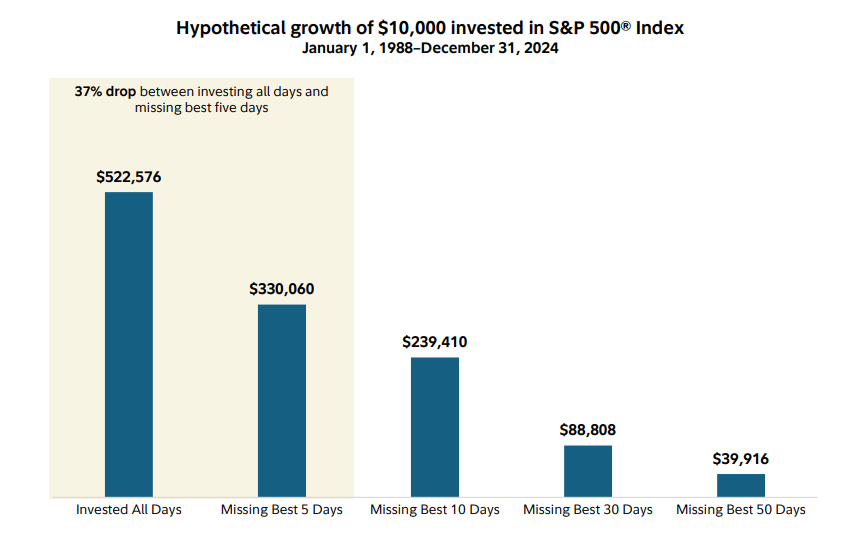

Trying to time the market—selling when it drops and buying when it recovers—can be a costly mistake. Missing just a few of the market’s best days can have a massive impact on long-term returns. The key is to stick with your investment plan, provided it was sound to begin with.

Median returns following large stock market selloffs (1950–2022)

If you’re feeling unsure, revisit your asset allocation. Are you diversified across different asset classes? Are your investments aligned with your time horizon and risk tolerance? If so, consider staying the course. If not, make thoughtful adjustments—not emotional ones.

And remember, downturns can be opportunities. If you’re still in the accumulation phase of your life, market dips may be a good time to invest at lower prices.

Hypothetical growth of $10,000 invested in the S&P 500 Index, January 1, 1988–December 31, 2024

6. Update Your Resume and Sharpen Your Skills

Even in a strong job market, layoffs can happen. As of February 2025, 7.6 million jobs remain open—down 877,000 from the previous year. While that’s still a healthy number, it’s a sign of a cooling labor market.

Don’t wait until you’re job hunting to update your resume. Keep it current with your most recent accomplishments, certifications, and responsibilities. Use platforms like LinkedIn to showcase your skills and expand your professional network.

At the same time, consider investing in yourself. Online courses, certifications, or professional development workshops can increase your value in the job market. Stay informed about what’s in demand in your industry, and take proactive steps to stay competitive.

Conclusion: Take Action While Times Are Good

The best time to prepare for a recession is before one starts. Think of recession-proofing as a form of financial insurance—it won’t prevent hard times, but it can reduce the damage and speed up your recovery.

To recap:

- Practice mindfulness and avoid emotionally driven financial decisions.

- Build or stress-test your financial plan to prepare for potential disruptions.

- Review your spending and look for ways to cut back or increase income.

- Prioritize emergency savings to cushion against short-term shocks.

- Stick with your investment strategy and avoid panic selling.

- Keep your resume updated and invest in your skills to stay employable.

Ultimately, recessions are temporary—but your long-term goals aren’t. By preparing today, you can navigate future uncertainties with confidence. If you need help designing or adjusting your financial plan, consider consulting with a financial advisor who can tailor strategies to your unique needs.

Remember: It’s not about predicting the future—it’s about being prepared for it.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/6-practical-strategies-to-recession-proof-your-life-and-fortify-your-finances.html