Saving for college can be a daunting task, especially when you’re not quite sure where to start. That’s why 529 plans were created—to help families save for college in an effective way. 529 plans are a popular way to save for college and have a range of advantages. In this guide, we’ll explain what 529 plans are, the benefits they offer, how they work, the tax advantages, how to manage them, contributing to them, withdrawing funds, selecting the right plan, the different types of plans available, and answer some common questions about them.

What is a 529 Plan?

A 529 plan is a tax advantaged savings plan designed to encourage saving for future college costs. It is named after Section 529 of the Internal Revenue Code, which created these types of savings plans in 1996. 529 plans are state sponsored investment plans and are available in every state. They are managed by professional financial firms, and many states offer more than one plan.

The Benefits of 529 Plans

The main benefit of 529 plans is that the money you contribute to them can grow over time and be used to pay for college expenses like tuition, room and board, books and supplies, and computers. They also offer a variety of tax advantages, including tax deferred growth, tax free withdrawals for qualified higher education expenses, and potential state tax deductions or credits.

Some of the key benefits of 529 plans include:

- Tax advantages: Contributions to a 529 plan are typically tax-free, and the money in the account grows tax-free as well. Withdrawals used for qualified education expenses, such as tuition, books, and room and board, are also tax-free.

- Flexibility: 529 plans are not limited to a specific school or type of education. The money can be used for any qualified education expenses at any eligible institution, including colleges, universities, trade schools, and graduate programs.

- Control: The account owner retains control over the account, and can change the beneficiary to another member of the family, or even keep the account for themselves if the original beneficiary does not end up going to college.

- Low barriers to entry: Many plans have low minimum contributions and investment options that have low fees.

- Potential state tax benefits: Some states offer additional tax benefits for contributions to a 529 plan, such as a deduction on state income taxes.

- Financial aid friendly: 529 plan assets are considered the student’s assets and not the parent’s assets, which can reduce the student’s eligibility for financial aid.

- Potential for growth: The money in a 529 plan can be invested in a variety of options, such as mutual funds or exchange-traded funds, which can provide the potential for growth over time.

Overall, 529 plans are a great way to save for college expenses, as they provide tax advantages, flexibility, control, and potential for growth. It’s always best to consult with a financial advisor to understand the best options for you and your family.

How Do 529 Plans Work?

Contributions to a 529 plan are invested in a variety of investments, such as stocks, bonds, and mutual funds. The money in the account will grow over time based on the performance of the investments in the plan. When the time comes to pay for college expenses, you can withdraw money from the 529 plan to cover the costs.

Tax Advantages of 529 Plans

One of the biggest advantages of 529 plans is that the money you contribute to them can grow tax deferred, meaning you won’t have to pay taxes on the growth until you withdraw the money. Additionally, when you withdraw the money to pay for qualified higher education expenses, the withdrawals are tax free. Some states also offer a tax deduction or credit for contributions to a 529 plan.

Managing Your 529 Plan

Once you’ve opened a 529 plan, you’ll need to manage it. This includes monitoring the investments in the plan, making sure your contributions are being invested in the right investments, and making sure the plan is on track to meet your goals.

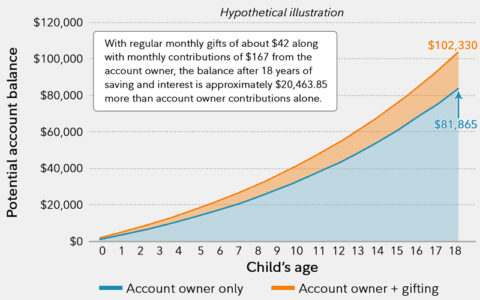

Contributing to a 529 Plan

Once you’ve opened a 529 plan, you can start contributing to it. You can make contributions as often as you’d like, up to the annual limit. There is also no limit on the amount you can contribute over the life of the plan.

Withdrawing Funds from a 529 Plan

When the time comes to pay for college expenses, you can withdraw money from your 529 plan to cover the costs. You can withdraw money for qualified higher education expenses such as tuition, fees, room and board, books and supplies, and computers.

Selecting a 529 Plan

There are many different 529 plans available, so it’s important to do your research to find the one that’s right for you. You should consider the fees and expenses associated with the plan, the investment options available, the performance of the investments, and the tax advantages offered by the plan.

Different Types of 529 Plans

There are two types of 529 plans: prepaid plans and savings plans. Prepaid plans allow you to pay for college tuition in advance at today’s prices, while savings plans are invested in a variety of investments and the money is used to pay for college expenses when the time comes.

There are two main types of 529 plans:

- Prepaid Tuition Plans: These plans allow you to purchase tuition credits at today’s prices for future use at participating colleges and universities. These plans are generally limited to state residents and to in-state colleges and universities.

- College Savings Plans: These plans allow you to invest money in a variety of investment options, such as mutual funds or exchange-traded funds, with the goal of accumulating enough money to cover future college expenses. These plans are available to residents of any state and can be used at any eligible college or university.

Additionally, there are also two main categories of College Savings Plans:

- Direct-sold plans: these plans are sold directly to the public by the state or educational institution that sponsors the plan.

- Advisor-sold plans: these plans are sold through financial advisors and might have higher fees and expenses compared to direct-sold plans.

Common Questions About 529 Plans

Q: Can I use a 529 plan to pay for private elementary or secondary school tuition?

A: No, 529 plans can only be used for qualified higher education expenses.

Q: Can I change the beneficiary of my 529 plan?

A: Yes, you can change the beneficiary of your 529 plan as long as the new beneficiary is a qualifying family member.

Conclusion

A 529 plan is a great way to save for college. It offers a variety of tax advantages and is a flexible, long term savings option. The money you contribute to a 529 plan can grow over time and be used to pay for qualified higher education expenses. It’s important to do your research when selecting a 529 plan to make sure it’s the right one for you.

Top Ten Key Takeaways

1. 529 plans are tax advantaged savings plans designed to help families save for college.

2. Contributions to a 529 plan can grow tax deferred and qualified withdrawals are tax free.

3. 529 plans are managed by professional financial firms and are available in every state.

4. Contributions to a 529 plan can be invested in a variety of investments, such as stocks, bonds, and mutual funds.

5. 529 plans offer both prepaid and savings plans.

6. You can withdraw money from a 529 plan to pay for qualified higher education expenses.

7. 529 plans have an annual limit on contributions, but no limit on the amount that can be contributed over the life of the plan.

8. Some states offer tax deductions or credits for contributions to a 529 plan.

9. It’s important to do research when selecting a 529 plan to make sure it’s the right one for you.

10. 529 plans are a great way to save for college and offer a variety of tax advantages.

Saving for college can be a daunting task, but with a 529 plan, you can get started on the right track and set your child up for success. With the information in this guide, you should now have a better understanding of 529 plans and be able to make an informed decision about whether a 529 plan is the right option for you.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/529-plans-a-guide-to-college-savings.html