A new year brings new opportunities to improve your financial health. With 2025 in full swing, now is the perfect time to set goals and plan for a more secure financial future. Among the top resolutions for many Americans are saving more money, paying off debt, and spending less. If saving is at the top of your list, this guide will help you achieve your goal by offering five simple yet impactful strategies to save at least $1,300 by year-end.

1. Commit to Saving: Treat It Like a Bill

Saving money starts with a mindset shift: treat your savings like a non-negotiable expense. This approach, known as “paying yourself first,” ensures that saving becomes a consistent priority. To make this actionable, set specific savings goals and break them into manageable amounts. For instance, if you aim to save $1,300 by December 31, you only need to save about $25 per week. Alternatively, saving $108.33 monthly achieves the same result.

Here are some tips to get started:

- Set Up a Separate Savings Account: This keeps your funds distinct and less tempting to spend.

- Track Spending: Use budgeting tools to identify areas where you can cut back and redirect those funds into savings.

- Celebrate Small Wins: Every dollar saved brings you closer to your goal.

2. Automate Your Savings

Automation is a powerful tool for ensuring consistent savings without requiring ongoing effort. It leverages behavioral psychology by reducing the friction associated with manual saving decisions.

Here’s how you can automate your savings:

- Direct Deposit: Allocate a portion of your paycheck to go directly into a savings account.

- Recurring Transfers: Set up automatic weekly or monthly transfers from your checking account to your savings account. Many banks and financial platforms offer this feature.

- Micro-Saving Apps: Use apps that round up your purchases to the nearest dollar and save the difference. Over time, these small amounts can add up significantly.

Fidelity’s Smart Habits program, for example, offers a 52-week challenge that starts with saving $1 in week one and builds to $52 in the final week, resulting in a total savings of $1,378—perfect for surpassing the $1,300 goal.

3. Build or Replenish Your Emergency Fund

An emergency fund is a cornerstone of financial stability. In 2025, many Americans are prioritizing rebuilding their emergency savings after a year of unexpected expenses.

Start small with a goal of saving $1,000 for emergencies. Then, aim to cover three to six months of essential expenses. Here are some ways to fast-track your emergency savings:

- Cut Non-Essential Spending: Cancel unused subscriptions, dine out less, or consider more affordable alternatives for entertainment.

- Sell Unused Items: Declutter your home and sell items you no longer need. Use platforms like eBay, Poshmark, or Facebook Marketplace.

- Earn Extra Income: Consider part-time work, freelancing, or gig economy opportunities like driving for rideshare services.

4. Maximize Tax-Advantaged Accounts

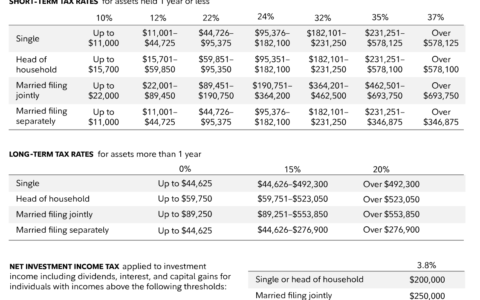

Tax-advantaged accounts are a smart way to grow your savings while taking advantage of tax benefits. These accounts include 401(k)s, IRAs, Health Savings Accounts (HSAs), and 529 education savings plans.

- Employer 401(k) Match: Contribute enough to maximize your employer’s match. This is essentially free money and can significantly boost your retirement savings.

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, contribute to an HSA. Funds grow tax-free and can be used for qualified medical expenses now or in the future.

- Roth IRA Contributions: Consider contributing to a Roth IRA if you’re eligible. While contributions are made with after-tax dollars, withdrawals in retirement are tax-free.

- Tax Credits: Research and utilize credits like the Earned Income Tax Credit (EITC) or Child Tax Credit, which can free up money for savings.

By leveraging these accounts, you can grow your wealth while reducing your tax burden.

5. Incrementally Increase Your Savings Rate

Small, incremental changes to your savings rate can yield significant results over time. For instance:

- Save Raises or Bonuses: If you receive a salary increase or a bonus, commit to saving at least half of it.

- Challenge Yourself: Aim to increase your savings rate by 1% every few months. If you currently save 5% of your income, work toward saving 6% by mid-year and 7% by year-end.

- Cut “Invisible” Expenses: Review subscriptions, utilities, and insurance premiums to identify opportunities for cost reduction. Redirect the savings into your financial goals.

Achieving Your $1,300 Savings Goal in 2025

Here’s an example plan to help you save $1,300 by December 31:

- Weekly Automation: Save $25 per week using automatic transfers.

- Tax Benefits: Contribute to an HSA or IRA and potentially save on taxes.

- Reduce Monthly Expenses: Cut $100 monthly from discretionary spending and redirect those funds to savings.

- One-Time Windfalls: Allocate part of your tax refund or a work bonus directly to savings.

Final Thoughts

Saving money doesn’t have to be overwhelming. With a clear plan, consistent effort, and the right tools, you can achieve your financial resolutions and set yourself up for a more secure future. By committing to these five easy strategies, you’ll not only save at least $1,300 by the end of 2025 but also build habits that pave the way for long-term financial success.

Author:Com21.com,This article is an original creation by Com21.com. If you wish to repost or share, please include an attribution to the source and provide a link to the original article.Post Link:https://www.com21.com/5-easy-money-wins-for-2025-save-at-least-1300-by-year-end.html